nys workers comp taxes

However retirement plan benefits are taxable if either of these apply. You may also contact the Task Force weekdays at 518 485-2144 between 8 am and 4 pm or send us an e-mail.

Film And Tv Industry Workers Compensation Explained

Albany NY 12206 518-437-6400 NYSIF.

. Harriman State Office Campus. The money you receive from your compensation claim is not taxable on either the state or federal level whether you receive monthly payments or obtained a lump sum settlement. If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45.

Workers compensation benefits for work injuries are tax-exempt if they are paid under the workers compensation act and also includes the survivors that receive benefits for fatal injuries. Even if youre a freelancer or sole proprietor and work alone you need to be in the know about. Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable.

I have a nys workers compensation form c-8 my lawyer says i will use this when i do my taxes. Ad Its Fast Easy To Get Workers Comp Coverage. This 5 is being phased in over 3 years.

It increases to 3 in 2020 then to 5 in 2021. Sole Props Entrepreneurs Small Shops Side Hustles. New York State Workers Compensation Board.

There will be a new IT-2104 for 2019 that has an area to address the ECET. This tax exempt status applies if the worker receives these benefits under a workers compensation act or law. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

The short answer to whether or not workers compensation benefits are taxable is quite simply no. If you withhold less than 700 during a calendar quarter pay the tax with your Form NYS-45. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. Overview When the Workers Compensation Board issues an award of compensation for a prior year disability period and any portion of the award is credited to NYS the State Insurance Fund sends a C8EMP Info form to OSC. You retire due to your occupational sickness.

Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny. Typically in New York workers that receive benefits from workers compensation due to an on the job injury are not subjected to taxes at the federal state or local levels. While a worker does need to report these benefits on New York tax form W-2 Wage and Tax Statements the amount awarded by the New York State Workers Compensation Board is excluded from.

Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act or a statute in the nature of a workers compensation act. A business must have an active NYSIF workers comp policy have more workers comp premium or payroll in New York State than in all other states combined and will be subject to NYSIF underwriting review to be eligible for NYSIFs out-of-state coverage. Workers Compensation Workers Compensation Benefits.

Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in the claim process. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors. - Answered by a verified Tax Professional.

He said my tax professional will know where this goes. For 2019 the rate is 15. So in most cases you dont have to worry.

Do you claim workers comp on taxes the answer is no. Copy A along with Form W-3 goes to the Social Security Administration. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

Employers will be required to pay a 5 state tax on all annual payroll expenses in excess of the 40000 threshold per employee. New York State Department of Labor. NYSIF expects to begin to offer out-of-state coverage beginning in the summer of 2022.

Liability and Determination Fraud Unit. Get information on medical benefits and help finding a provider. In most cases they wont pay taxes on workers comp benefits.

Workers compensation benefits are not considered taxable income at the federal state and local levels. Building 12 - Room 282. Workers Compensation Board Workers Compensation Law 158 25-a 151 214 and 228.

By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. The state has its own State Insurance Fund SIF which is a. Insurers authorized to transact workers compensation and employers liability insurance are subject to assessments by the Workers Compensation Board for the administrative costs of the Board Special Disability Fund Fund for Reopened Cases and.

I want to do my own taxes so i was wondering if someone could tell me what line to put the amount from the c-8 form. 1 Watervliet Ave Ext. Failure to comply with state workers compensation insurance rules can result in serious penalties and other liabilities.

The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable. In New York state law requires employers to cover all employees with workers compensation and disability insurance. New York State Insurance Fund- SIF.

Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income. According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes. Workers comp benefits are non-taxable insurance settlements.

Also under IRS regulations non-taxable workers compensation-related benefits are not eligible for salary deferral under the New York State Deferred Compensation Plan NYSDCP. The quick answer is that generally workers compensation benefits are not taxable. We use cookies to give you the best possible experience on our website.

Is workers comp taxable in NYS for either State or Federal. You are responsible to pay the amount you withhold to the Tax Department as follows. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees.

20 Park Street Albany NY 12207 518-474-6670 NY Workers Compensation Board. Or you can complete the Tip Sheet. New York is not an NCCI as they are under the jurisdiction of NYCIRB.

Can I Get Disability After A Workers Comp Settlement

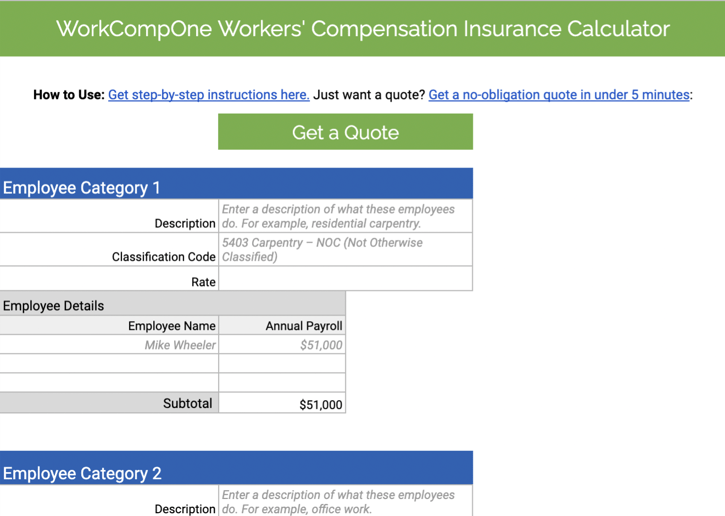

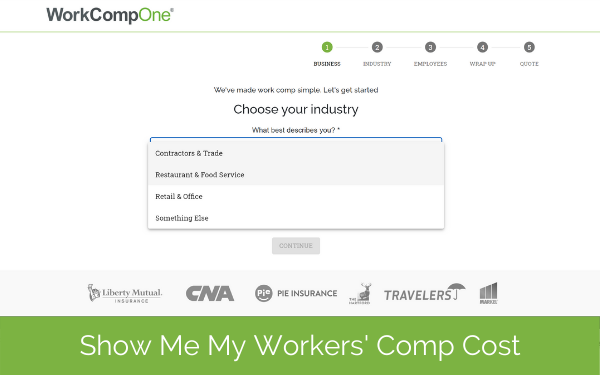

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

5 Requirements For Workers Compensation Eligibility

How To Calculate Workers Compensation Cost Per Employee

Workers Compensation Insurance Overview Amtrust Financial

Workers Comp Is Never Off The Clock

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Average Workers Comp Settlement Amounts How Much Is My Case Worth

Business Index A Z Certificate Of Attestation Basically A Form Saying That I Don T Need Workers Comp Because I Don T Have Em Business Online Business Express

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Pin By Parkchester Medical On Parkchestermedical Org Workers Compensation Insurance Injury Lawyer Personal Injury Law

Workers Compensation Insurance Costs Vary By State And Depend On A Variety Of Factor Workers Compensation Insurance Compare Insurance Small Business Insurance

What Wages Are Subject To Workers Comp Hourly Inc

Direction Accounting And Financial Planning 02 6584 6222 Branding Design Logo Pointers Navigation

Is Workers Comp Taxable Workers Comp Taxes

Self Employed Vs Small Business Owner How Status Affects Your Profit Business Tax Deductions Small Business Owner Business Tax